- Home

- >

- About us

About us

A trusted partner in the Public-Private Partnership (PPP) market, making responsible long-term investments to create sustainable value in the communities we invest in

Queenspoint is a long term investment vehicle and asset manager which acquires, holds and actively operates middle market core infrastructure assets -in fields such as transport, energy, telecommunications, waste, water and others- largely under PPP contractual and risk allocation structures.

The company is 100% owned by German insurance and financial services company Allianz SE through the following entities, on a 50/50 basis: Allianz Infrastructure Luxembourg I (through its fully owned affiliate Allianz Infrastructure Spain HoldCo I) and by Allianz European Infrastructure Fund I (through its fully owned affiliate Allianz European Infrastructure Acquisition Holding). Both of Queenspoint´s shareholders are managed by Allianz Capital Partners, which is one of the Allianz Group's in-house asset managers for alternative equity investments and part of Allianz Global Investors.

Queenspoint´s maiden investment was a bundle of four minority stakes in three operational transport PPP assets and a maintenance company, all acquired in 2015 (please refer to our Portfolio section for more details):

20%

Metro Ligero Oeste (MLO), which operates two light rail lines and 29 stations in Madrid

36.5%

Linia 9 Tram 4 (L9T4), which operates 13 stations of the L9 metro line in Barcelona

36.5%

Linia 9 Tram 2 (L9T2), which operates 15 stations of the L9 metro line in Barcelona

36.5%

Linia 9 Manteniment (L9M), which is the maintenance company for the two L9 PPPs in Barcelona

Please refer to our Contact section for more details.

CONTACT

Our shareholder

Allianz SE owns 100% of Queenspoint, which is managed by Allianz Capital Partners (“ACP”), the in-house asset manager for infrastructure investments of the Allianz Group.

ACP is one of the Allianz Group's asset managers for alternative equity investments and is part of Allianz Global Investors. ACP focus on investing in private equity, infrastructure and renewable energy, and are located in Munich, London, Luxembourg, New York and Singapore.

ACP manages investments held by vehicles (e.g. Allianz Infrastructure Luxembourg I) participated by the Allianz insurance companies. Additionally, ACP manages Allianz funds (e.g. Allianz European Infrastructure Fund I) participated by Allianz insurance companies and Allianz´s institutional clients.

Due to their long investment horizon and attractive risk/return profile, ACP´s investments in private markets are an ideal match for the requirements of Allianz insurance companies and Allianz´s institutional clientes, given their long-term liabilities.

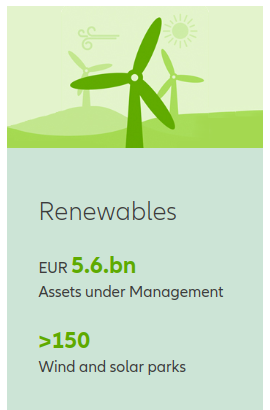

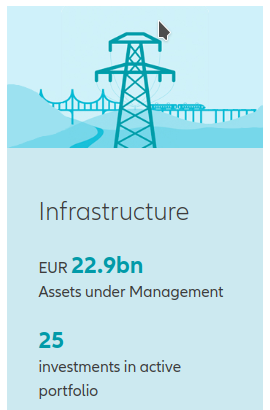

ACP key figures Q3 2023

Please visit www.allianzcapitalpartners.com for more details.